How To Do Your Taxes Like The Wealthy

Uncategorized

Nov 30, 2018

You don't have to own a small island or a luxury jet to take a (legal) hint from how millionaires and billionaires protect their money from taxes. Here are three ways you can navigate your own taxes like the wealthy do:

Assess your taxable income

Your first step is to know how you are being taxed, especially because the new tax laws are in effect for 2018. Taxable income is whatever money you made during the year, minus deductions or exemptions. It includes your salary, wages, bonuses, tips, and investment and unearned income.

Close to dropping a bracket? The big breaks in the new tax bill for married taxpayers filing jointly is below $77,400 (12% vs. 22%) and below $315,000 (24% vs. 32%).

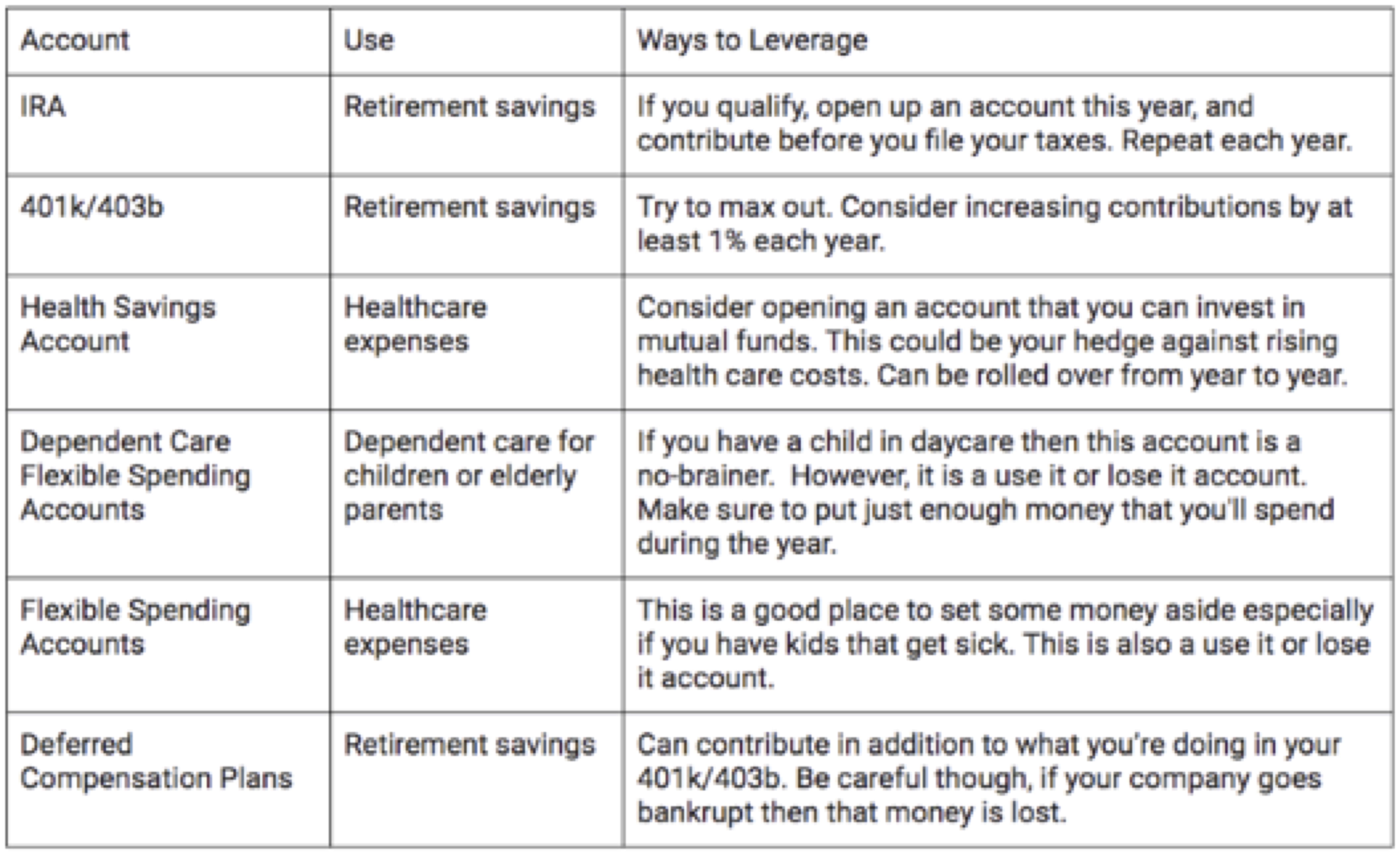

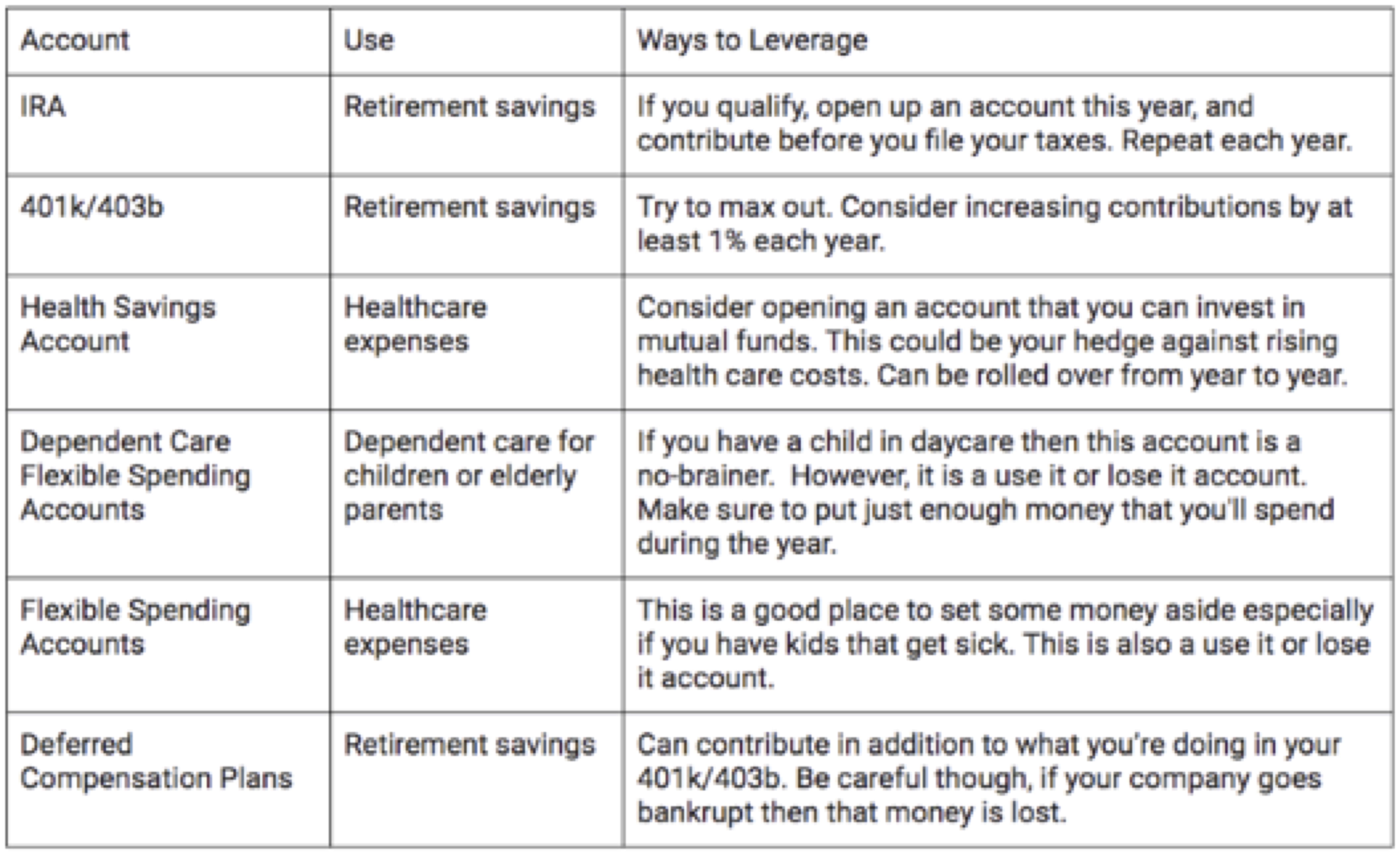

If you do find yourself on the edge of a bracket (or not), look for opportunities to reduce your taxable income this year. Here are some ways to leverage different accounts you may have available to you.

Charitable donations

Now that the standard deduction has increased from $12,700 for people married filing jointly to $24,000, you may want to double up on your giving every other year.

Why double up instead of giving the same amount every year? The new tax plan has a deduction limit of $10,000 for anyone who chooses to itemize income, sales (income), and property taxes. If you live in a state with high income taxes and property taxes, you are likely to hit that cap.

For example, let's say you file your taxes jointly with a spouse, max out your property tax at $10,000, and you have a mortgage interest of $10,000. If you usually make $4,000 in charitable contributions every year, you can hold off and make an $8,000 donation every other year so you can itemize. Depending on your tax bracket, this could save you quite a bit on your taxes.

Roth conversions

If you have a traditional IRA, it's worth thinking about making a conversion for the tax-free benefits later. Plus, anyone who inherits your Roth will not have to pay any federal income on their withdrawals, as long as the account has been open more than five years.

Traditional IRAs require that you take a minimum distribution (RMD) starting at age 70 ½. This could bump you into another tax bracket in retirement, so you may want to consider reducing your balance. Using Roth conversions when you're older reduces your RMD and can significantly reduce your tax liability when you have to start taking distributions at 70 1/2. So if you're able to reduce your RMDs now, it has the potential to cost you less in taxes down the road.

Tax brackets have shifted, which means you may get more back on your tax return for 2018. Put that money to good use and convert some of it to a Roth IRA.

The bottom line

There is a new tax law in town, and not brushing up on these changes could cost you. Take a hint from the wealthy and take full advantage of the tax benefits and deductions you are entitled to. It pays to be thorough and understand where you can gain some tax breaks. If you have extra money you want to invest, pay attention to options with tax benefits, like HSAs and retirement accounts. Working with TAX R US can help you find opportunities for savings and ways to maximize your investment tax benefits.